Go back

Unified process for verifying customers and evaluating creditworthiness

An integrated solution that balances fast customer onboarding with robust credit checks for financing with less risk.

Check it out

Lets start with the Measurable Impact first

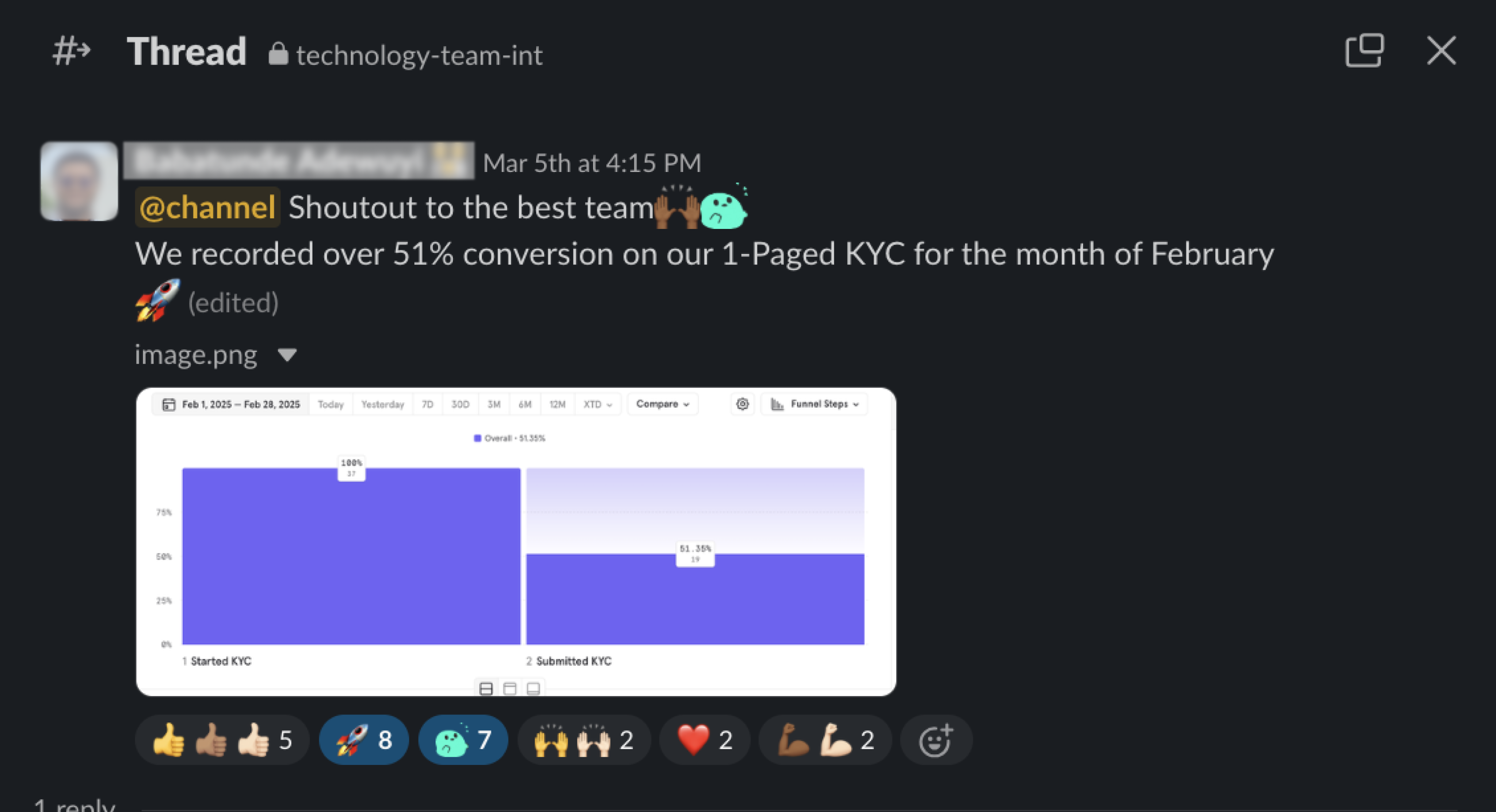

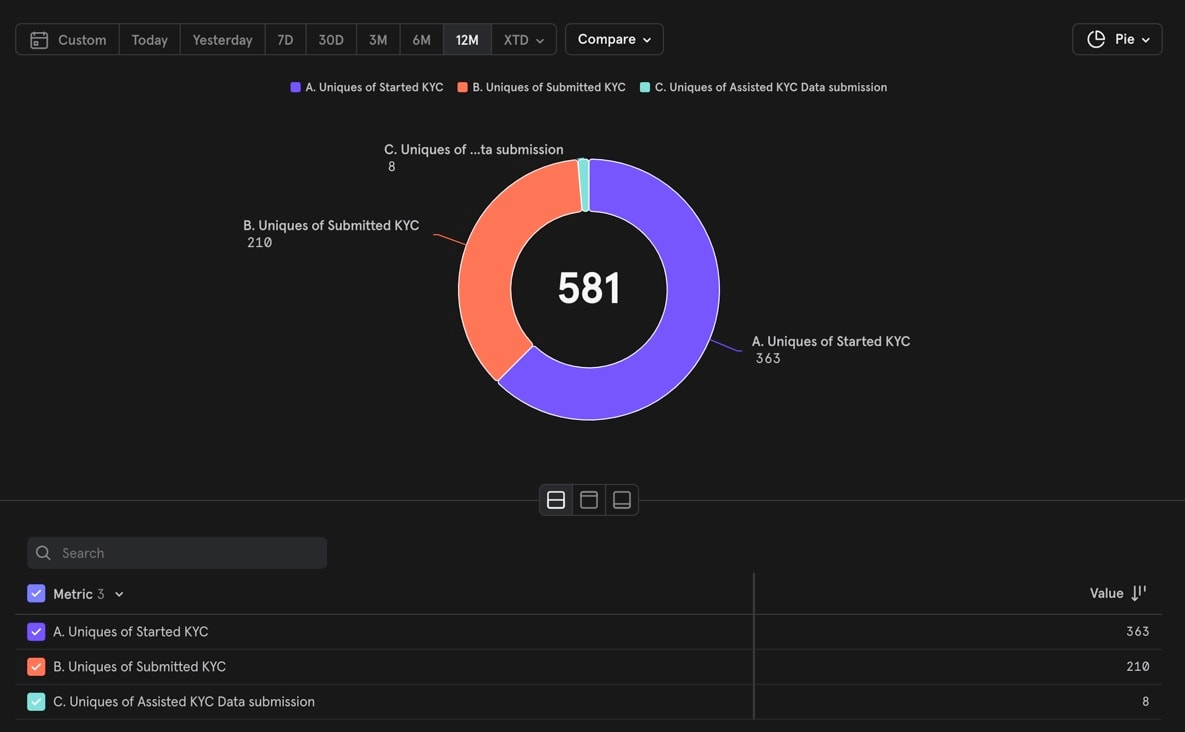

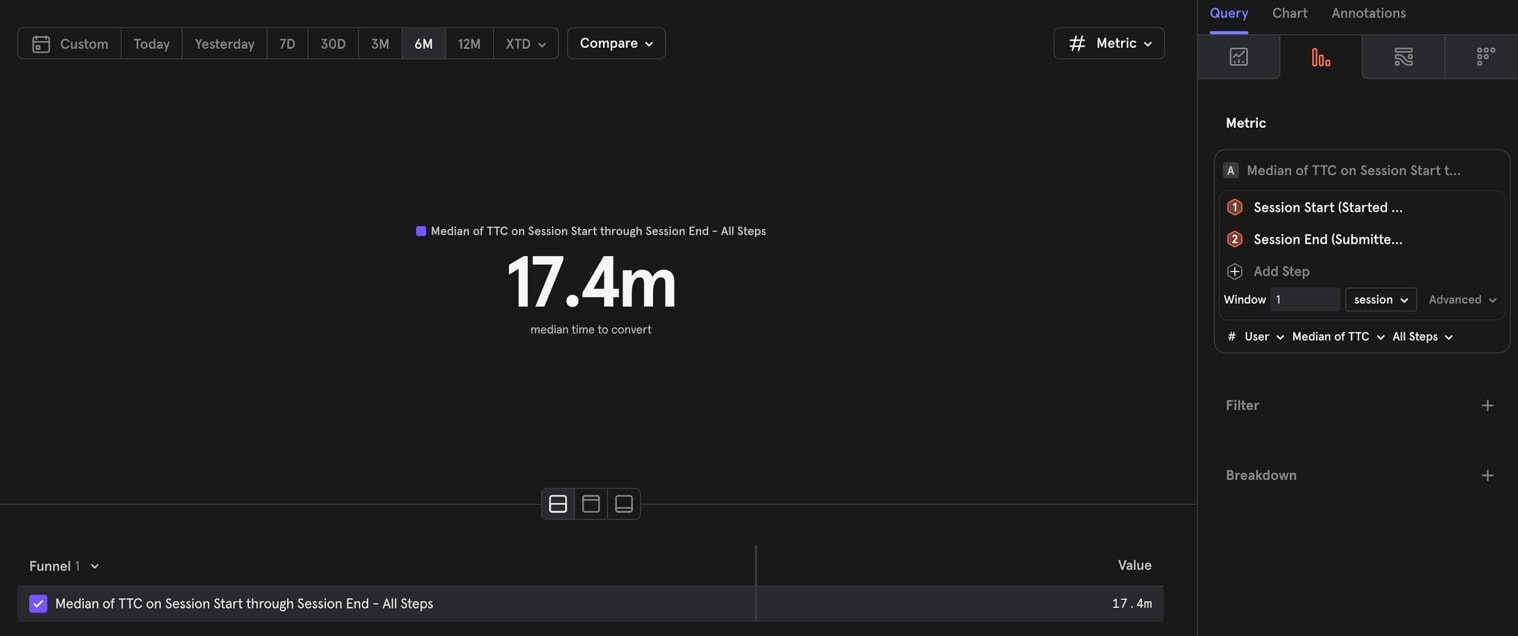

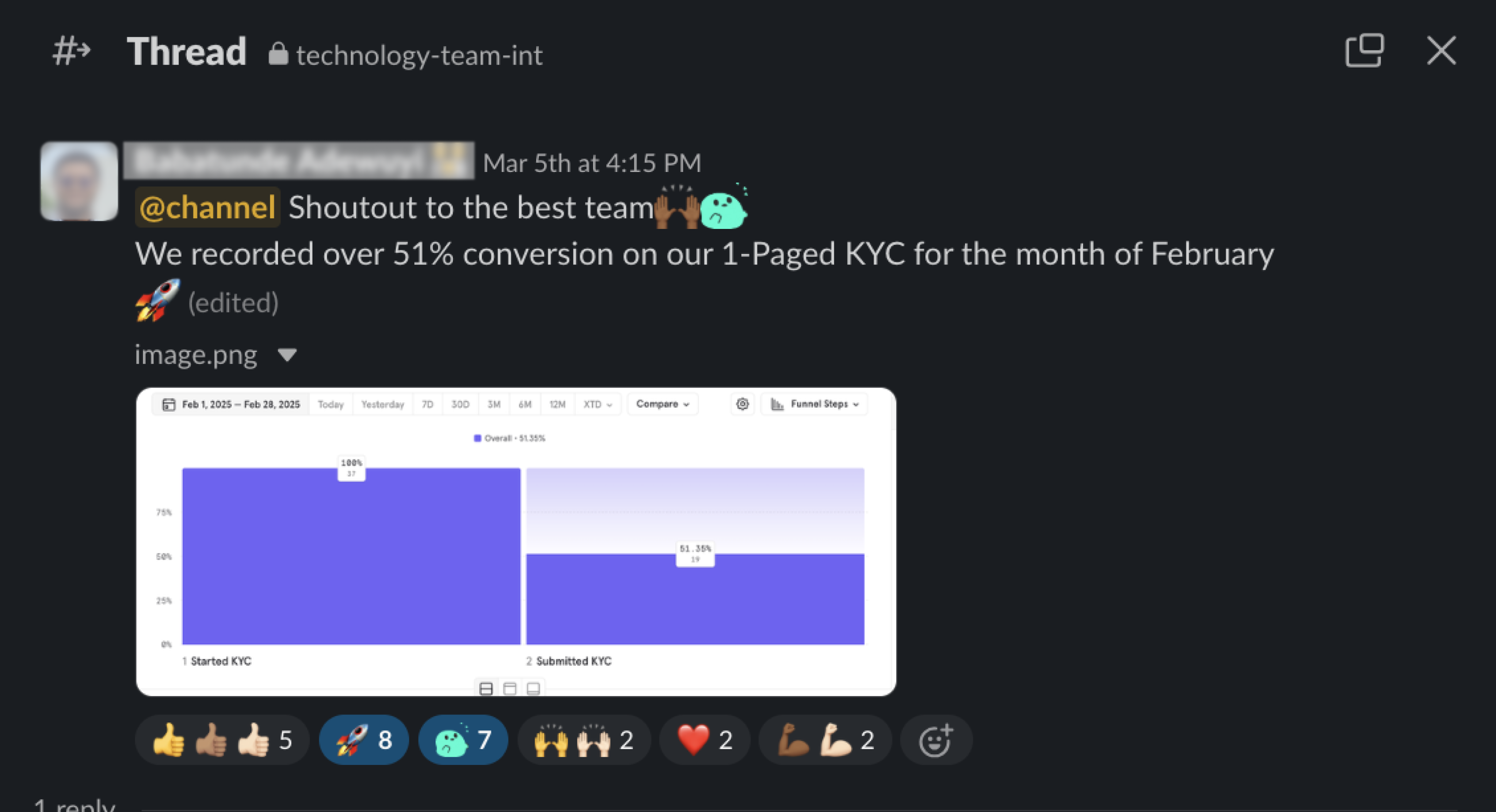

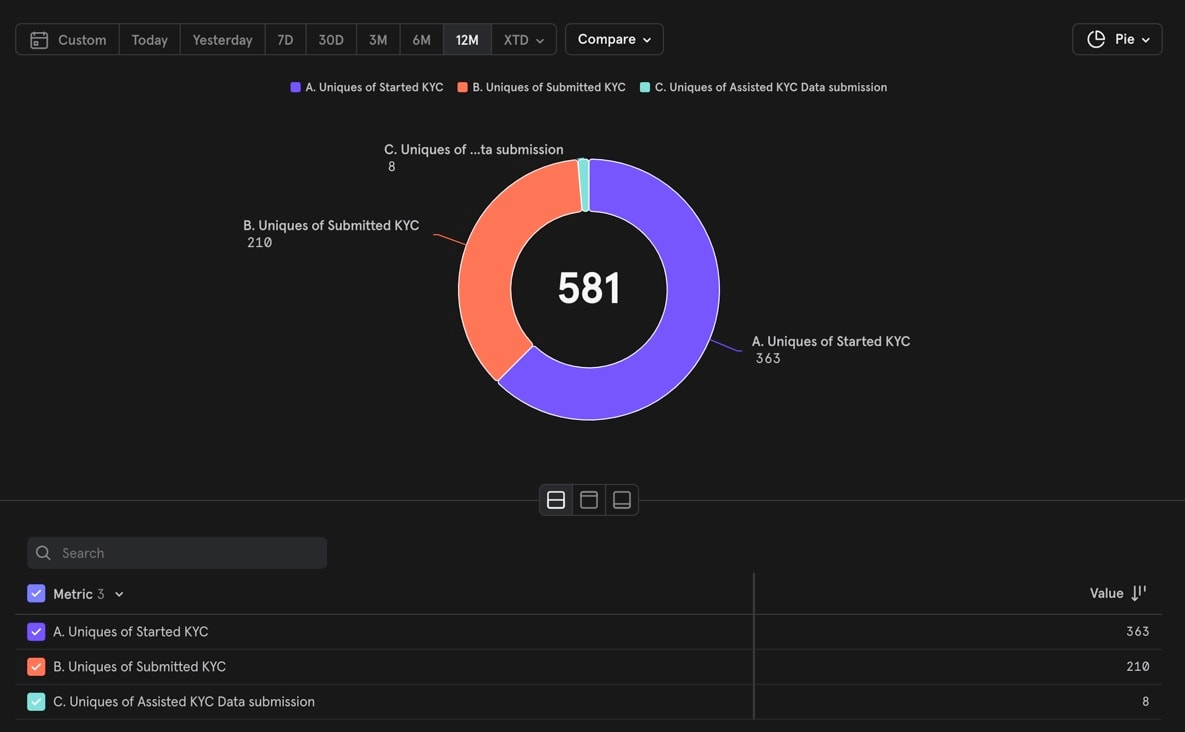

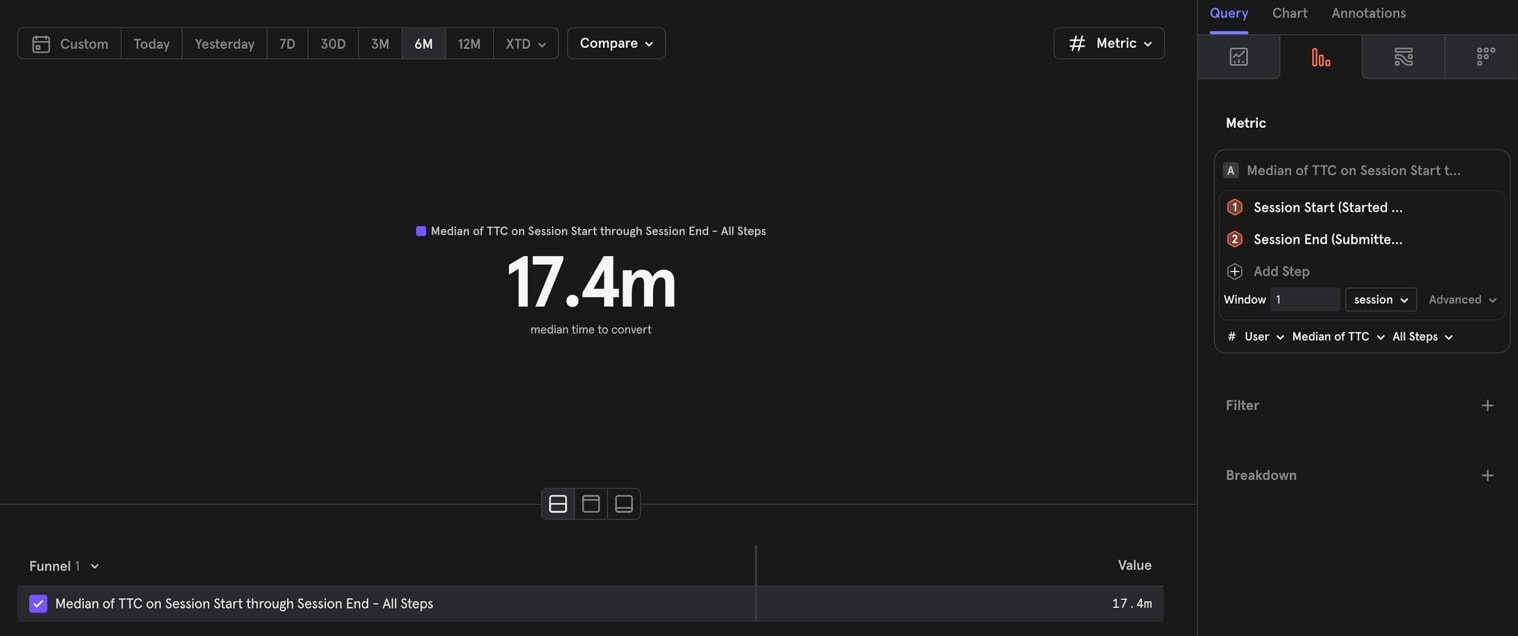

For a product with a high default and drop-off rate during KYC, the introduction of this approach for KYC & credit risk model transformed SunFi’s financing process into one that was fast, compliant, and data-driven.

📑

Average KYC completion time dropped from over 32hours to an average of 15 minutes—users who took longer did so only because they didn't have certain documents on hand and needed to retrieve them later

📈

Default rates decreased noticeably to <10% as SunFi began approving only well-qualified applicants.

Some screenshots from Mixpanel showing the impact across time to complete, etc. of the new KYC approach

Overview

SunFi needed a way to make solar financing more accessible — without exposing the business to high default risks. The existing process made it easy for customers to apply, but difficult to evaluate who could reliably repay.

To solve this, we designed a unified KYC and credit assessment system that streamlined how SunFi verifies individuals and businesses, while introducing a data-driven model to evaluate creditworthiness. The goal was to balance fast onboarding with responsible, risk-aware lending.

The Problem

Initially, SunFi’s financing process lacked structure and insight. Customers could apply easily, but SunFi couldn’t accurately assess repayment ability or credit risk — leading to:

💡

High default rates due to weak evaluation models.

💡

Long KYC completion times (some users took more than a day).

💡

Drop-offs occurred during onboarding because users found the process complex and unclear.

💡

Limited compliance controls, with manual or missing AML and liveness checks.

We needed to design an integrated system that was fast, compliant, and capable of identifying genuine, creditworthy applicants.

My Role

As the lead Product Designer, I collaborated closely with stakeholders across credit, data, and compliance teams to translate complex financial models into an intuitive, trustworthy experience.

Responsibilities included:

💡

Designing the KYC/KYB flow for both individuals and businesses.

💡

Translating the credit scoring model into usable interface logic.

💡

Testing and iterating multiple onboarding experiences.

💡

Introducing admin workflows for manual review and overrides.

Stakeholders

- SunFi Admins (Internal users): Review applications, assess risk scores, and override automated decisions when necessary.

- Consumers (Individuals & Businesses): Apply for solar financing and complete the KYC/KYB process through SunFi’s platform.

Our north star 🌟

“Design a unified KYC process that users can complete in minutes — while giving SunFi enough insight to make confident, data-driven lending decisions.”

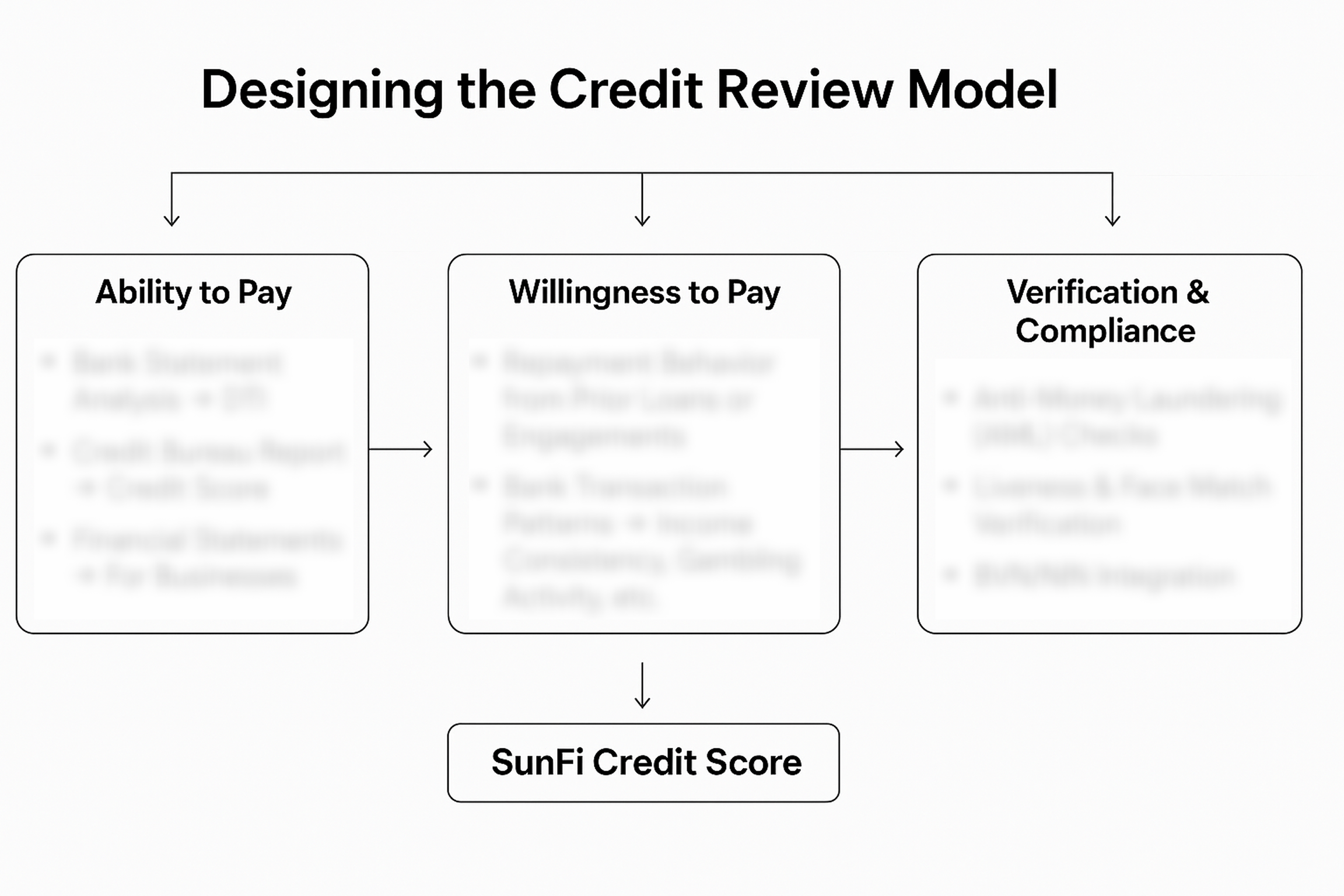

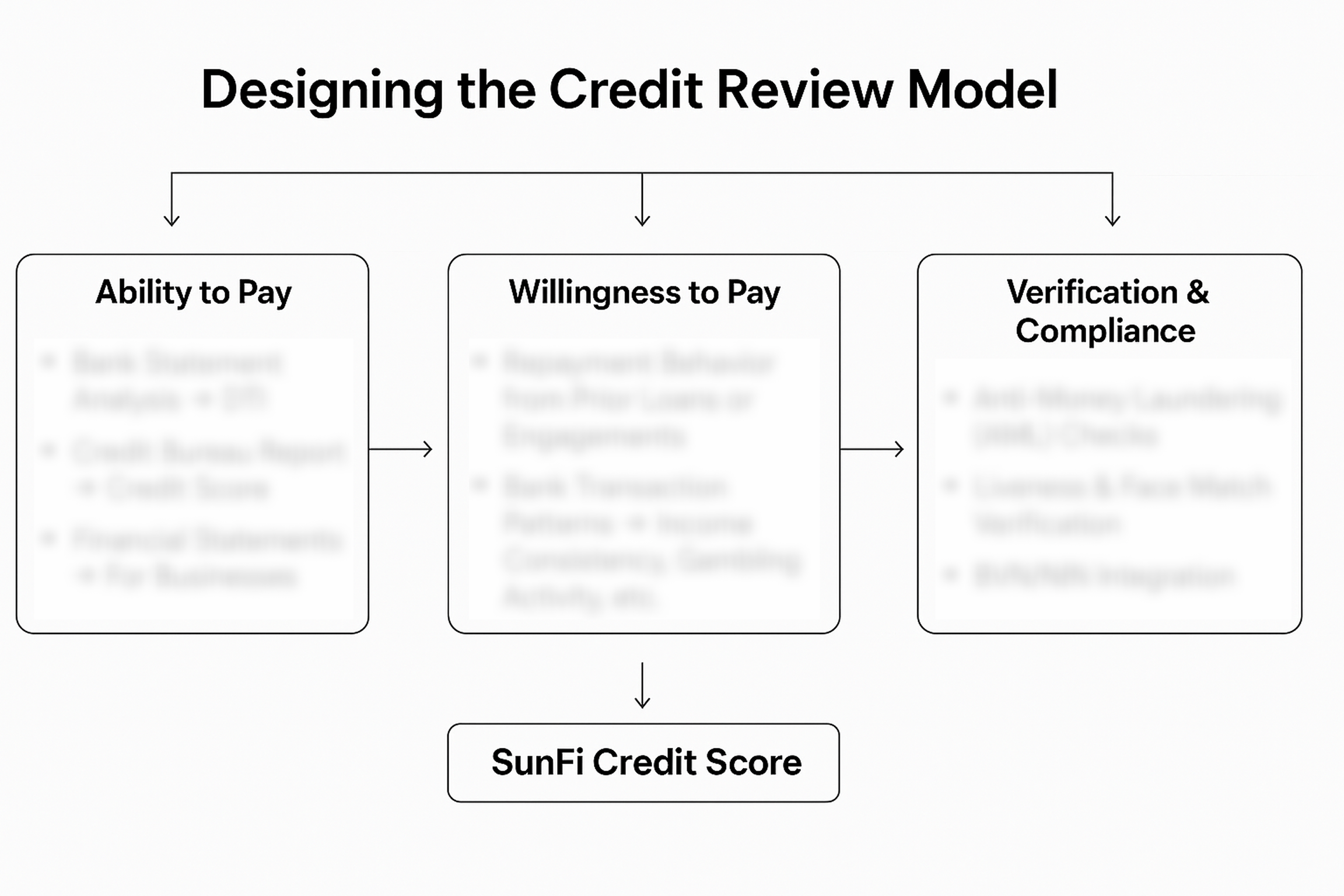

Designing the Credit Review Model

In collaboration with the leadership, data, and risk teams, we developed a multidimensional assessment framework that combines financial, behavioral, and contextual data to evaluate each applicant’s ability and willingness to pay.

Certain parts of the model have been blurred to protect confidential information.

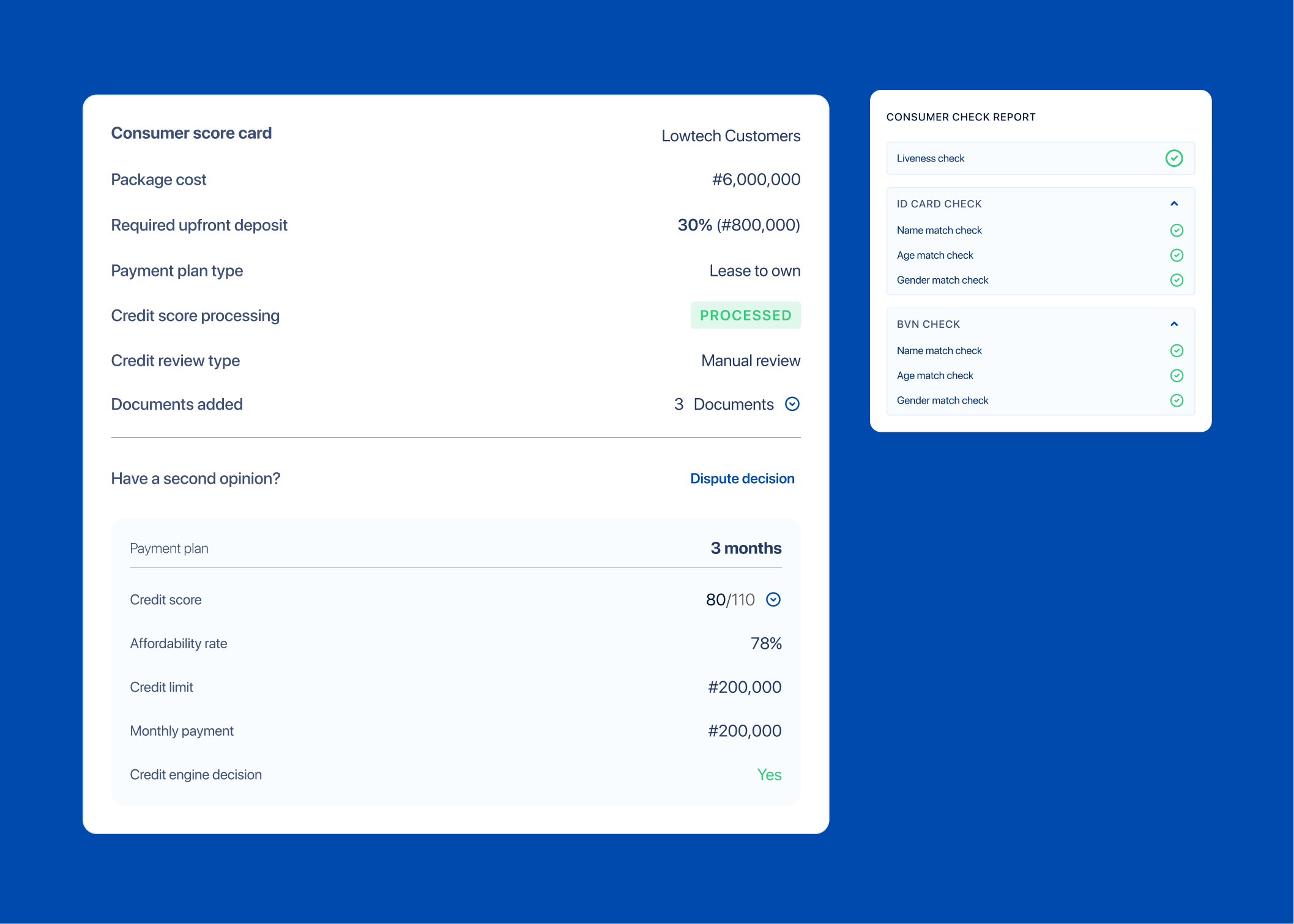

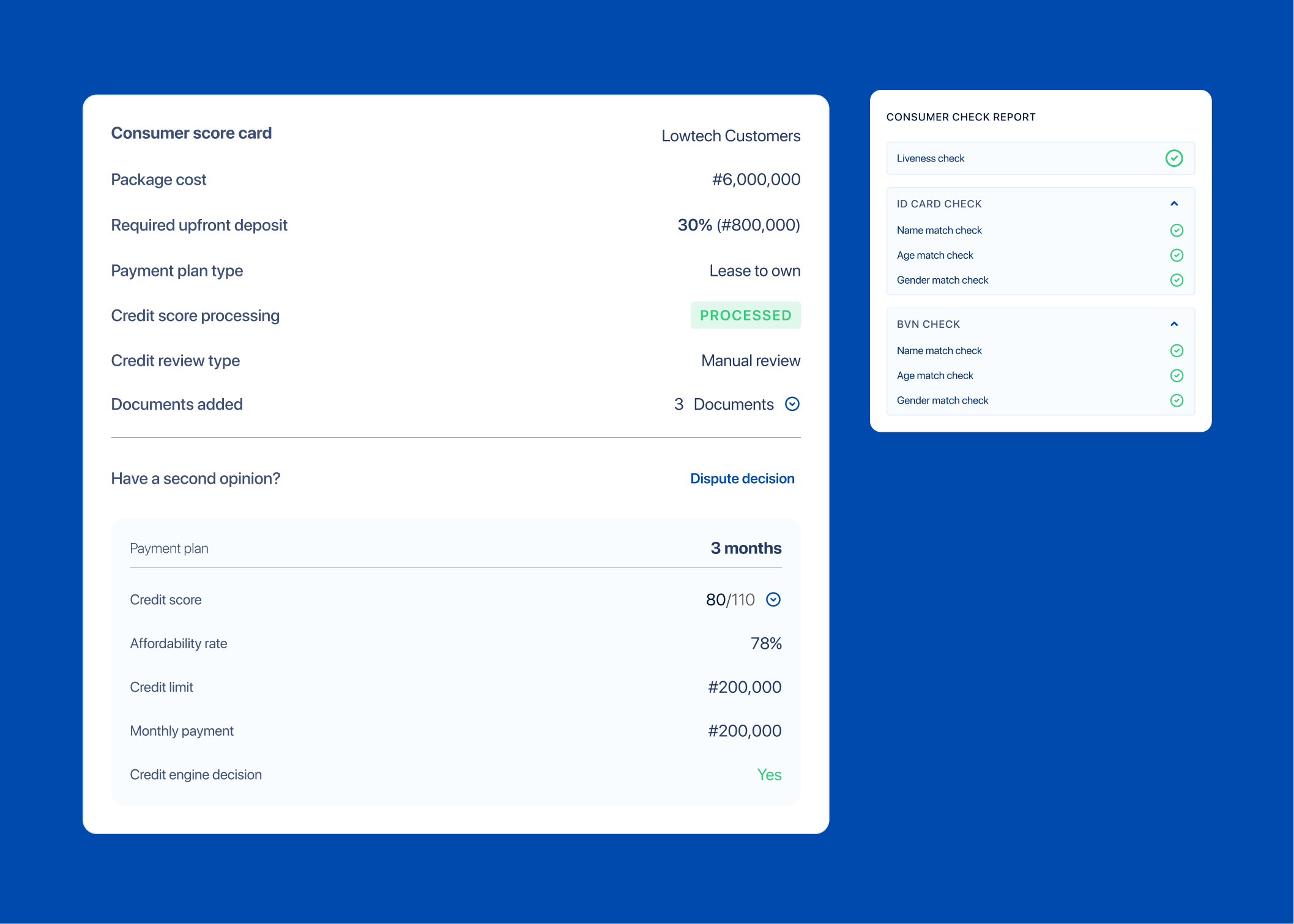

Each applicant received a SunFi Credit Score, automatically determining financing eligibility. However, to ensure fairness and control, we also designed an admin override system, allowing authorized reviewers to adjust or approve decisions based on additional context.

Next phase

After we developed this framework, we needed to decide exactly what data we would collect from the users. The goal was to collect data that the consumers would understand why we needed that data, and the consumers could easily provide.

We decided to ask the consumers questions about the data they would be willing to provide, a particular user’s feedback stood out to me:

“

Giving out my bank statement of 12-24 months. I gave it out because at the time I really needed the solution but there’s this fear of not knowing if you’ll be given the solution but you’ve given out your bank statement and your data (BVN, NIN).

The user is particularly saying that, after giving his data out, and he’s not eligible for the financing, he needs to know that his data is still safe.

Ideation & Prototyping: First Iteration

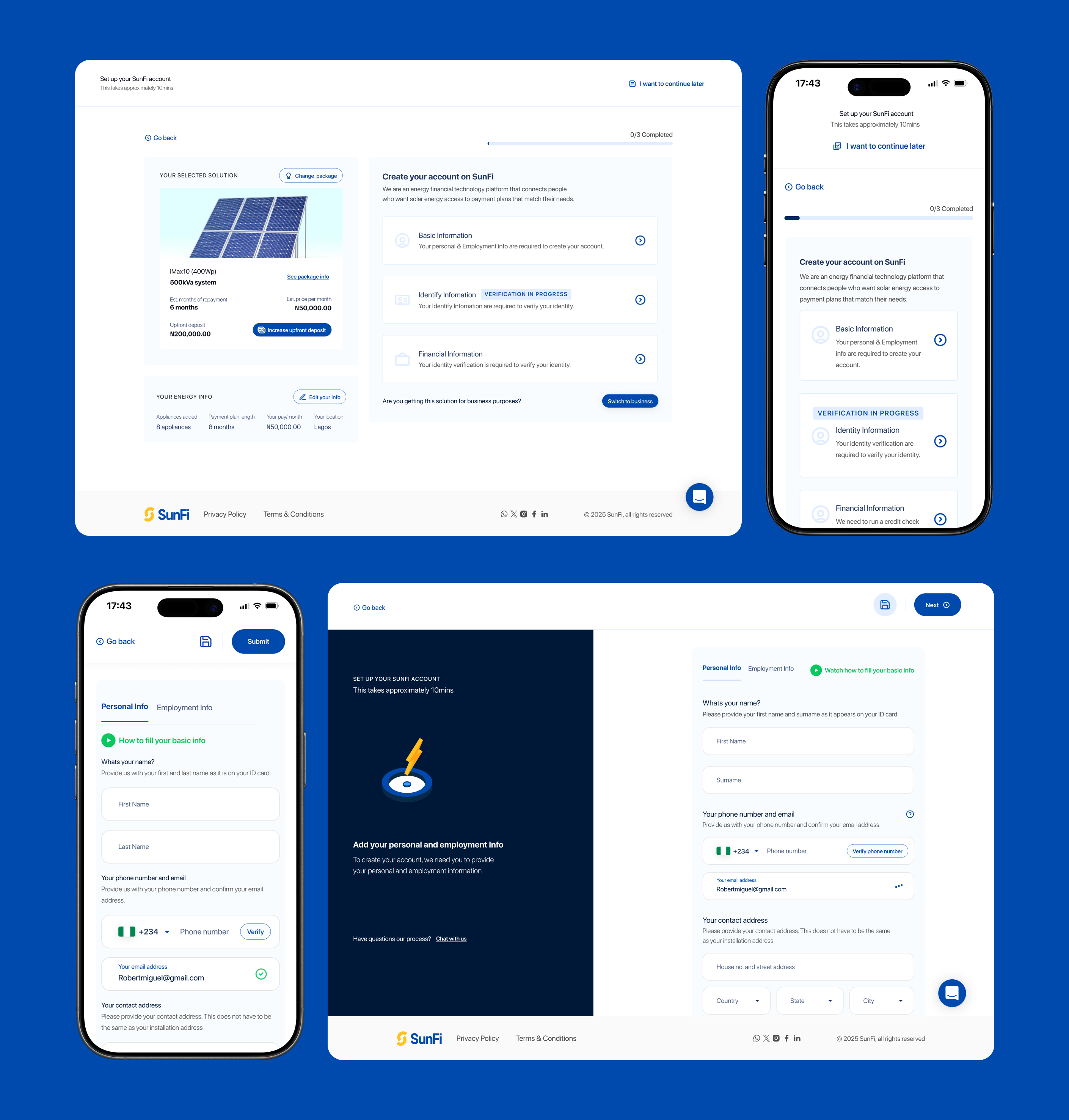

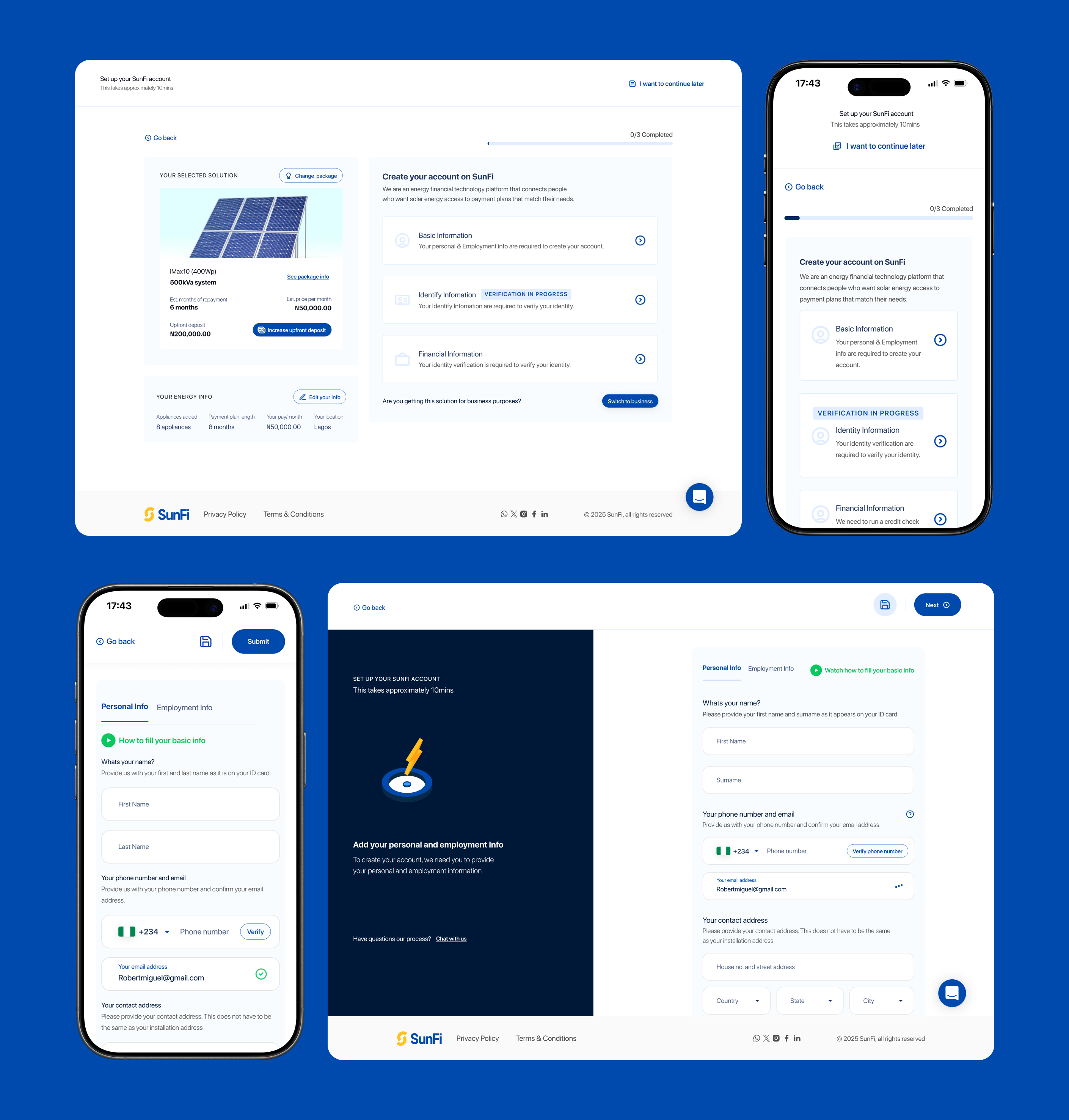

Our initial design featured a multi-step onboarding layout — a structured series of pages guiding users through data entry for personal information, documents, financials, and verification.

The rationale was to prevent users from feeling overwhelmed by too much information at once—especially in a form context.

The first iteration using a multi-step approach

After the first iteration went live, we stayed close and kept tracking the data.

While the layout appeared organized, the data tracking revealed several usability issues:

💡

Users needed to click through multiple steps before starting the form for each category.

💡

Many paused or abandoned the process midway, increasing completion times.

💡

Some users misunderstood certain fields, requiring follow-ups from support teams.

During the first 4–6 months post-launch, data confirmed that users were taking more than a full day on average to complete their KYC, and drop-off rates were still high, even though we could still see some improvements in the default rates dropping down to about 10%.

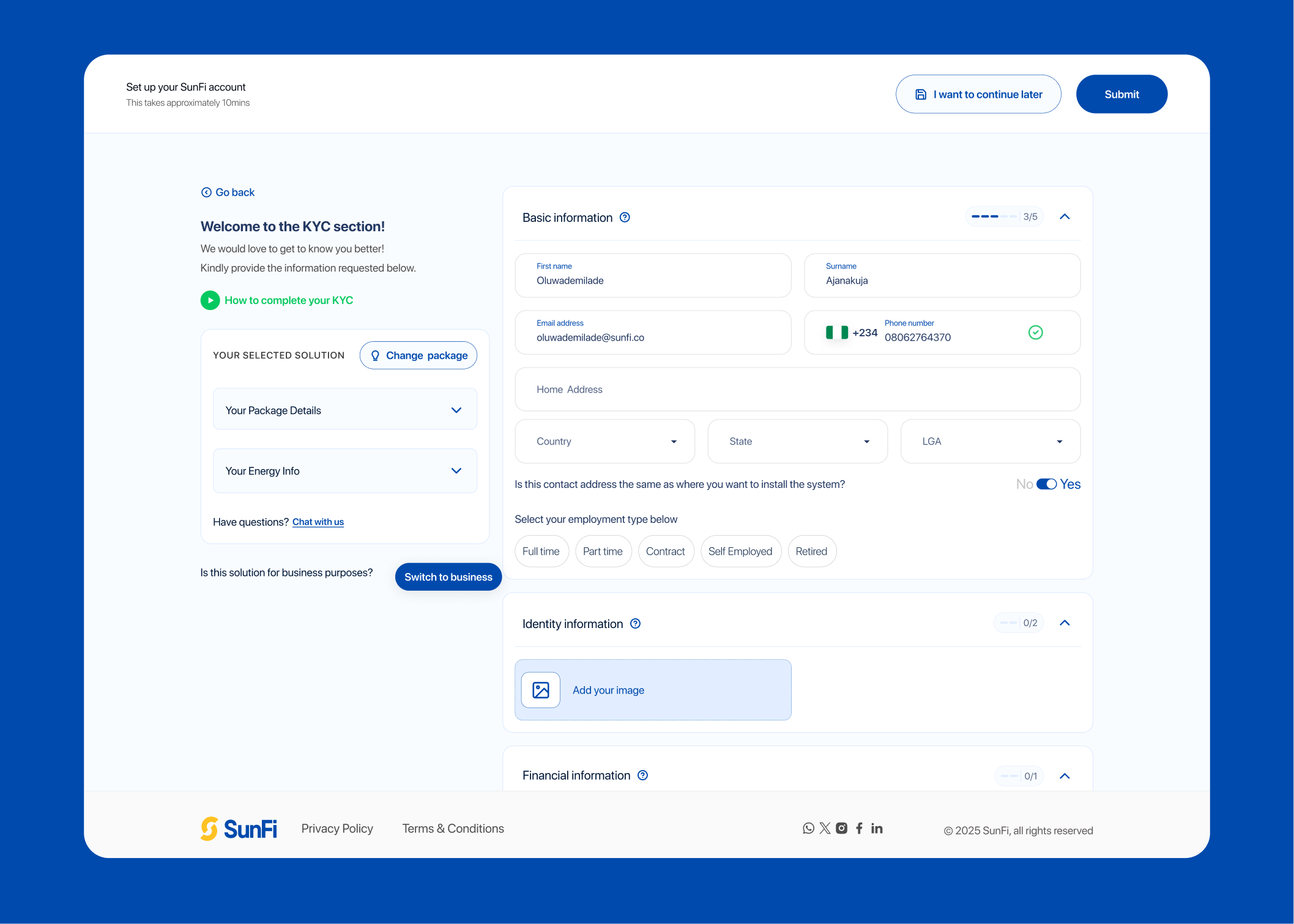

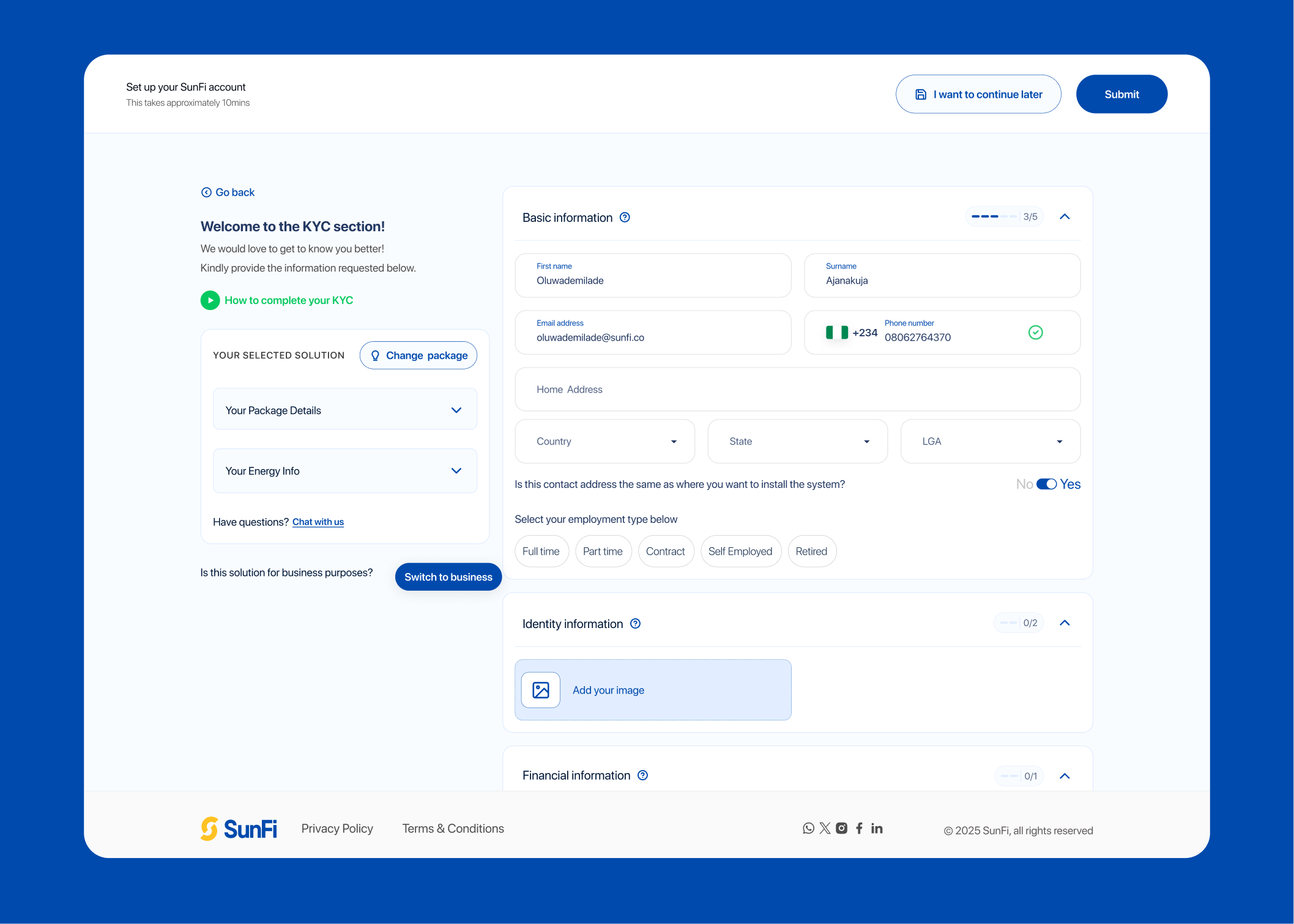

Second Iteration: Streamlined One-View Form (One-paged KYC)

To address these issues, we redesigned the experience into a single-entry, streamlined layout, eliminating unnecessary steps and reducing cognitive load.

Key improvements included:

💡

Removed the multi-step navigation, allowing users to start immediately.

💡

Condensed fields using smart grouping and progressive disclosure.

💡

Clearer copywriting to explain why each piece of data was requested.

The second iteration using a collapsible and expandable approach for each sections

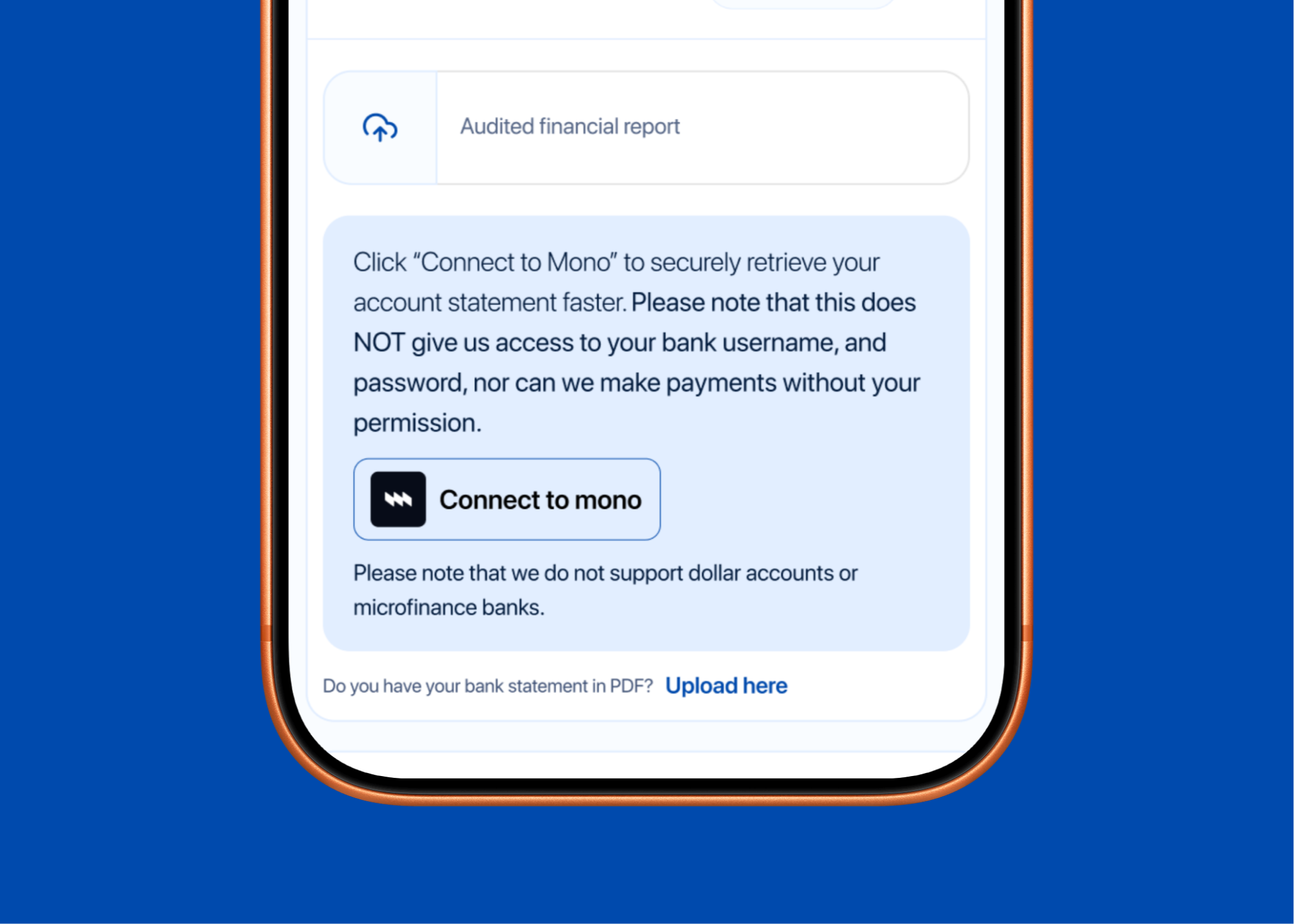

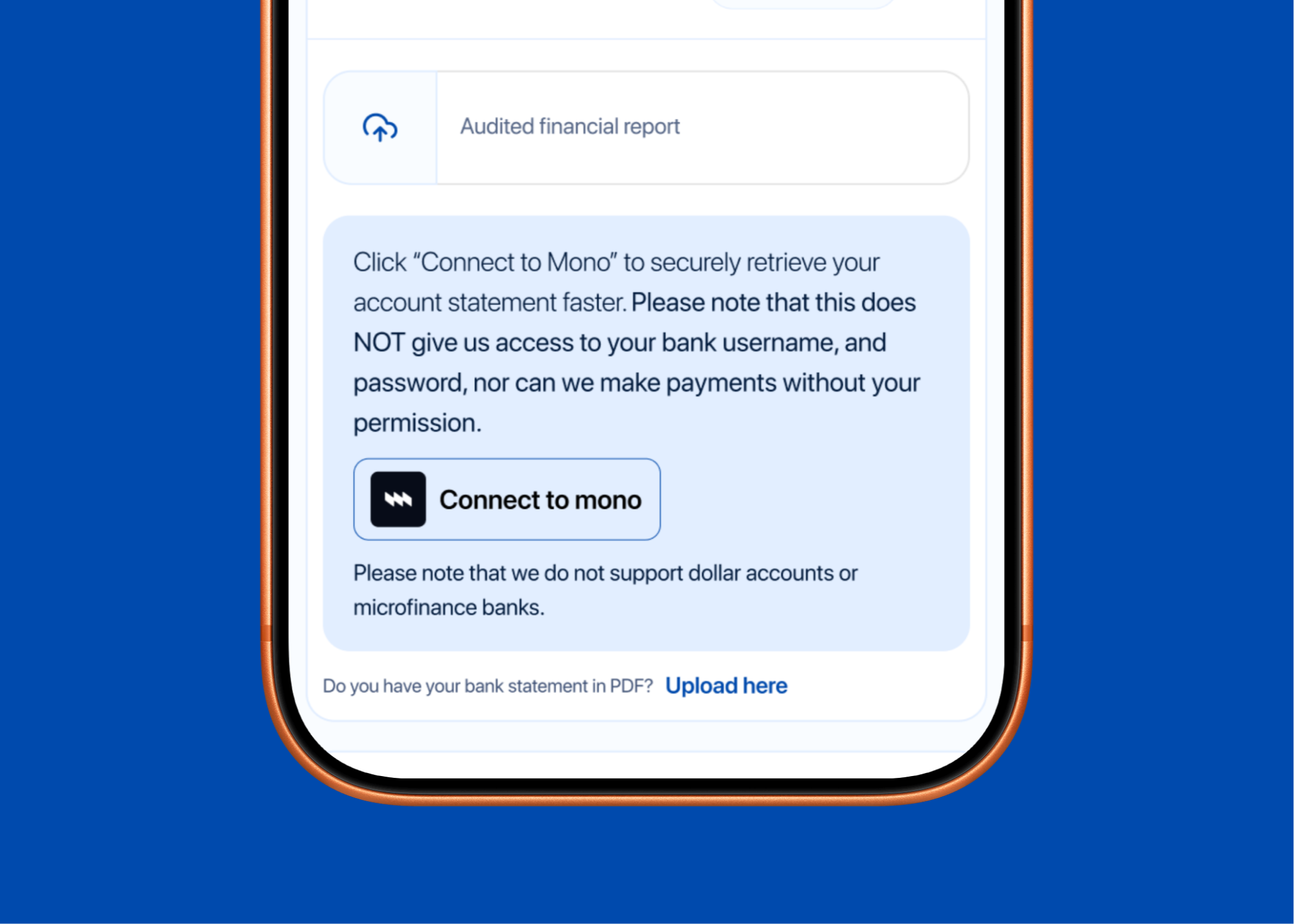

Solving the problem of data trust, especially with the user’s bank statement

With the feedback the user provided about ensuring their data, in this case, their bank statement, is still saved even if they might not be eligible. Ensured to introduce a section where the user understands that their data is safe before the user can go ahead to add their bank statements.

Image showing the option for consumers to connect with mono (A safe third-party product for retrieving bank statements)

SunFi Admin Experience

The design also extended to SunFi's internal tools, giving admins better control over risk and compliance for post-approval support. The admin override feature made the system more functional—when a decision was made outside the platform that contradicted the credit model, admins could update it directly in the system. This was important for the business, especially in cases involving partnerships.

Credit decision results are showing on the internal tool designed

💡

View detailed applicant summaries and credit scores.

💡

Inspect supporting documents (bank statements, financial reports, etc.).

💡

Override automated decisions when external validation was needed.

💡

Track verification results (e.g., AML, liveness, and identity checks).

This way, they could now:

Reflections

This project showcased how thoughtful UX and data-driven logic can coexist — balancing simplicity for users with rigor for the business.

By redesigning both the customer onboarding and admin review flows, we created a system that builds trust, ensures financial responsibility, and empowers SunFi to grow its financing arm sustainably.

Ultimately, this unified KYC and credit assessment process turned what was once a high-risk, high-friction experience into a **fast, transparent, and reliable financing journey.**

Go back

Unified process for verifying customers and evaluating creditworthiness

An integrated solution that balances fast customer onboarding with robust credit checks for financing with less risk.

Check it out

Lets start with the Measurable Impact first

For a product with a high default and drop-off rate during KYC, the introduction of this approach for KYC & credit risk model transformed SunFi’s financing process into one that was fast, compliant, and data-driven.

📑

Average KYC completion time dropped from over 32hours to an average of 15 minutes—users who took longer did so only because they didn't have certain documents on hand and needed to retrieve them later

📈

Default rates decreased noticeably to <10% as SunFi began approving only well-qualified applicants.

Some screenshots from Mixpanel showing the impact across time to complete, etc. of the new KYC approach

Overview

SunFi needed a way to make solar financing more accessible — without exposing the business to high default risks. The existing process made it easy for customers to apply, but difficult to evaluate who could reliably repay.

To solve this, we designed a unified KYC and credit assessment system that streamlined how SunFi verifies individuals and businesses, while introducing a data-driven model to evaluate creditworthiness. The goal was to balance fast onboarding with responsible, risk-aware lending.

The Problem

Initially, SunFi’s financing process lacked structure and insight. Customers could apply easily, but SunFi couldn’t accurately assess repayment ability or credit risk — leading to:

💡

High default rates due to weak evaluation models.

💡

Long KYC completion times (some users took more than a day).

💡

Drop-offs occurred during onboarding because users found the process complex and unclear.

💡

Limited compliance controls, with manual or missing AML and liveness checks.

We needed to design an integrated system that was fast, compliant, and capable of identifying genuine, creditworthy applicants.

My Role

As the lead Product Designer, I collaborated closely with stakeholders across credit, data, and compliance teams to translate complex financial models into an intuitive, trustworthy experience.

Responsibilities included:

💡

Designing the KYC/KYB flow for both individuals and businesses.

💡

Translating the credit scoring model into usable interface logic.

💡

Testing and iterating multiple onboarding experiences.

💡

Introducing admin workflows for manual review and overrides.

Stakeholders

- SunFi Admins (Internal users): Review applications, assess risk scores, and override automated decisions when necessary.

- Consumers (Individuals & Businesses): Apply for solar financing and complete the KYC/KYB process through SunFi’s platform.

Our north star 🌟

“Design a unified KYC process that users can complete in minutes — while giving SunFi enough insight to make confident, data-driven lending decisions.”

Designing the Credit Review Model

In collaboration with the leadership, data, and risk teams, we developed a multidimensional assessment framework that combines financial, behavioral, and contextual data to evaluate each applicant’s ability and willingness to pay.

Certain parts of the model have been blurred to protect confidential information.

Each applicant received a SunFi Credit Score, automatically determining financing eligibility. However, to ensure fairness and control, we also designed an admin override system, allowing authorized reviewers to adjust or approve decisions based on additional context.

Next phase

After we developed this framework, we needed to decide exactly what data we would collect from the users. The goal was to collect data that the consumers would understand why we needed that data, and the consumers could easily provide.

We decided to ask the consumers questions about the data they would be willing to provide, a particular user’s feedback stood out to me:

“

Giving out my bank statement of 12-24 months. I gave it out because at the time I really needed the solution but there’s this fear of not knowing if you’ll be given the solution but you’ve given out your bank statement and your data (BVN, NIN).

The user is particularly saying that, after giving his data out, and he’s not eligible for the financing, he needs to know that his data is still safe.

Ideation & Prototyping: First Iteration

Our initial design featured a multi-step onboarding layout — a structured series of pages guiding users through data entry for personal information, documents, financials, and verification.

The rationale was to prevent users from feeling overwhelmed by too much information at once—especially in a form context.

The first iteration using a multi-step approach

After the first iteration went live, we stayed close and kept tracking the data.

While the layout appeared organized, the data tracking revealed several usability issues:

💡

Users needed to click through multiple steps before starting the form for each category.

💡

Many paused or abandoned the process midway, increasing completion times.

💡

Some users misunderstood certain fields, requiring follow-ups from support teams.

During the first 4–6 months post-launch, data confirmed that users were taking more than a full day on average to complete their KYC, and drop-off rates were still high, even though we could still see some improvements in the default rates dropping down to about 10%.

Second Iteration: Streamlined One-View Form (One-paged KYC)

To address these issues, we redesigned the experience into a single-entry, streamlined layout, eliminating unnecessary steps and reducing cognitive load.

Key improvements included:

💡

Removed the multi-step navigation, allowing users to start immediately.

💡

Condensed fields using smart grouping and progressive disclosure.

💡

Clearer copywriting to explain why each piece of data was requested.

To still avoid overwhelming users, we made each section collapsible. This allowed users to expand and collapse sections as they completed them or chose where to begin.

The second iteration using a collapsible and expandable approach for each sections

Solving the problem of data trust, especially with the user’s bank statement

With the feedback the user provided about ensuring their data, in this case, their bank statement, is still saved even if they might not be eligible. Ensured to introduce a section where the user understands that their data is safe before the user can go ahead to add their bank statements.

Image showing the option for consumers to connect with mono (A safe third-party product for retrieving bank statements)

SunFi Admin Experience

The design also extended to SunFi's internal tools, giving admins better control over risk and compliance for post-approval support. The admin override feature made the system more functional—when a decision was made outside the platform that contradicted the credit model, admins could update it directly in the system. This was important for the business, especially in cases involving partnerships.

Credit decision results are showing on the internal tool designed

This way, they could now:

💡

View detailed applicant summaries and credit scores.

💡

Inspect supporting documents (bank statements, financial reports, etc.).

💡

Override automated decisions when external validation was needed.

💡

Track verification results (e.g., AML, liveness, and identity checks).

Reflections

This project showcased how thoughtful UX and data-driven logic can coexist — balancing simplicity for users with rigor for the business.

By redesigning both the customer onboarding and admin review flows, we created a system that builds trust, ensures financial responsibility, and empowers SunFi to grow its financing arm sustainably.

Ultimately, this unified KYC and credit assessment process turned what was once a high-risk, high-friction experience into a fast, transparent, and reliable financing journey.